Texas business owners leaving thousands on the table don’t realize one simple fact: S-Corporation election can save $9,000-$15,000+ annually in self-employment taxes for businesses netting $80,000 or more. The difference between operating as a sole proprietor or LLC versus electing S-Corp status comes down to how the IRS treats your income—and that treatment creates massive tax savings.

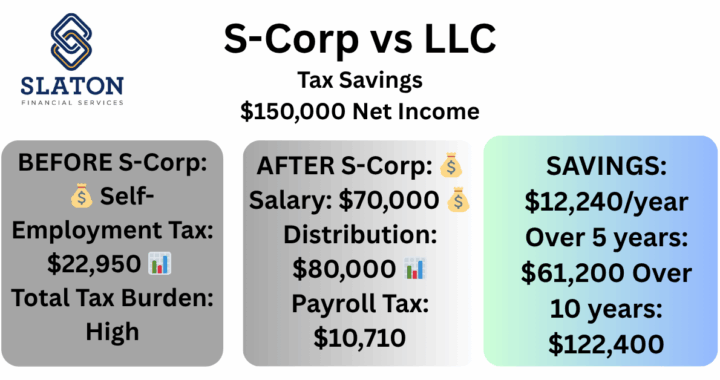

The math is straightforward: sole proprietors pay 15.3% self-employment tax on all net income. S-Corp owners pay that same 15.3% only on salary portions, not on distributions. For a Texas business netting $150,000, that’s the difference between $22,950 and $12,240 in employment taxes—a $10,710 annual savings.

Understanding S-Corp Tax Treatment in 2025

An S-Corporation isn’t a separate business entity. It’s a tax election available to LLCs and corporations that changes how the IRS taxes your business income. While C-Corporations face the 21% federal corporate tax rate plus individual taxes on dividends (double taxation), S-Corps use pass-through taxation where business income flows directly to owners’ personal tax returns.

The key advantage comes from splitting income into two categories: W-2 wages (subject to 15.3% payroll taxes) and distributions (not subject to the 15.3% self-employment tax). This split creates immediate savings compared to sole proprietorships and standard LLCs, where owners pay self-employment tax on every dollar of net income.

For 2025, the self-employment tax rate remains 15.3%, consisting of 12.4% for Social Security (on wages up to $176,100) and 2.9% for Medicare (on all wages). Self-employment tax applies to 92.35% of net earnings, making the effective rate about 14.13% on gross profits.

Real Tax Savings: The Numbers

A Los Angeles consultant earning $210,000 in 2024 paid approximately $32,130 in self-employment tax as a sole proprietor. After restructuring as an S-Corp with an $85,000 salary and $125,000 in distributions, payroll taxes dropped to $13,003—saving $19,127 annually. After accounting for additional compliance costs, the consultant kept $16,813 extra that first year.

These savings compound across multiple years. Over five years, that consultant saves $84,065 in employment taxes. Over ten years, $168,130. These aren’t theoretical numbers—they’re documented savings from proper S-Corp structuring.

Consider a Texas-based consulting firm earning $150,000 net income. As a sole proprietor, self-employment tax totals $22,950 (15.3% of $150,000). Structuring as an S-Corp with a $70,000 salary and $80,000 distribution reduces employment tax to $10,710—an annual savings of $12,240.

The Reasonable Salary Requirement

The IRS requires S-Corp owners to pay themselves “reasonable compensation” for services performed. You cannot pay yourself a $20,000 salary while taking $180,000 in distributions. The IRS audits S-Corps specifically looking for unreasonably low salaries and will reclassify distributions as wages, plus assess penalties and interest.

Factors the IRS examines when determining reasonable compensation include your training and experience, duties and responsibilities, time and effort devoted to the business, industry compensation data for similar roles, the company’s financial condition and dividend history, economic conditions, and geographic location.

General guidelines suggest full-time owner-operators should pay themselves 40-60% of net income as salary. Part-time involvement justifies lower percentages. Multiple owners each need reasonable compensation. Document your reasoning for salary levels to minimize audit risk.

For a Texas business earning $120,000 net income, a reasonable salary might be $60,000-$72,000. Using $65,000 as salary and $55,000 as distribution, you’d pay $9,945 in payroll taxes instead of $18,360 in self-employment tax as a sole proprietor—saving $8,415 annually.

S-Corp Costs to Consider

S-Corporation election isn’t free. Additional annual costs typically include payroll processing ($1,200-$3,000), additional CPA fees for Form 1120-S preparation ($500-$2,000), state franchise fees ($50-$800 depending on state), registered agent fees if required ($100-$300), and accounting software upgrades ($200-$500). Total estimated costs run $2,000-$4,500 annually.

The break-even analysis is straightforward: you generally need $60,000+ in net business income for S-Corp tax savings to exceed additional costs. At $80,000 net income with $40,000 salary, you save approximately $6,120 in employment taxes. Subtract $3,000 in S-Corp costs, and you keep $3,120 extra annually.

At $120,000 net income with $60,000 salary, you save $9,180. After $3,000 in costs, net savings reach $6,180. At $200,000 net income with $100,000 salary, you save $15,300. After costs, you keep $12,300 extra.

Our S-Corp calculator at slatonfs.com/scorp-tax-calculator shows your exact break-even point based on your specific revenue, expenses, and proposed salary.

Who Benefits Most from S-Corp Status

S-Corporation election works best for consultants and independent contractors, professional services providers including lawyers, doctors, architects and engineers, real estate agents and brokers, software developers and tech professionals, marketing and creative agencies, and any service business generating $80,000+ in consistent net income.

Businesses that may not benefit include those with net income under $60,000 (savings don’t cover costs), companies planning to sell or dissolve soon (administrative burden isn’t worth short-term savings), businesses with significant losses or inconsistent income (no income to save taxes on), passive real estate investors (special rules apply), and businesses seeking venture capital or outside investors (S-Corps have shareholder restrictions).

Texas-specific advantages include no state income tax, simplifying S-Corp compliance compared to states like California or New York that impose additional S-Corp taxes. Texas does assess franchise tax on S-Corps, but rates remain relatively low compared to other states’ tax burdens.

Ongoing S-Corp Compliance Requirements

Operating as an S-Corp requires meeting specific obligations: quarterly payroll tax deposits using Form 941, annual Form 1120-S corporate tax return (due March 15), Schedule K-1 distribution to each shareholder, reasonable salary documentation, corporate minutes and resolutions, state annual reports and franchise taxes, and separate business bank accounts (required for liability protection).

Missing deadlines or failing to pay reasonable salaries can result in IRS reclassification of your entity, penalties, interest, and back taxes owed. The administrative burden increases compared to sole proprietorships, but for businesses generating sufficient income, the tax savings far exceed the additional effort.

How to Elect S-Corp Status

The S-Corporation election process involves several steps. First, form your entity—you must be an LLC or Corporation before electing S-Corp status. Sole proprietors must form an LLC or incorporate first.

Second, obtain an EIN (federal tax ID) from the IRS if you don’t already have one. This typically takes minutes online.

Third, file Form 2553 (Election by Small Business Corporation) with the IRS. Timing matters: file by March 15 for current-year election, or within 2 months and 15 days of entity formation. Late elections may not take effect until the following tax year, costing you a year of potential savings.

Fourth, set up payroll systems and processing. This includes establishing a payroll schedule, setting up tax withholdings, and ensuring proper reporting.

Fifth, determine and document your reasonable salary based on industry standards and your role.

Sixth, make quarterly estimated tax payments for both payroll obligations and your personal income taxes on distributions.

Finally, file annual returns including Form 1120-S (due March 15) and provide Schedule K-1s to all shareholders.

Texas Business Structure Comparison

Texas businesses have multiple structure options, each with different tax implications:

Sole proprietorships and single-member LLCs without elections are taxed identically. All net income faces 15.3% self-employment tax plus personal income tax rates (10-37% for 2025). No double taxation, but highest employment tax burden. Simple compliance with Schedule C on personal return.

Multi-member LLCs without elections file Form 1065 (partnership return). Each member receives Schedule K-1 showing their share of income. All income faces self-employment tax for active members. Pass-through taxation avoids double taxation.

LLCs electing S-Corp status maintain LLC liability protection while gaining employment tax savings. Split income into salary (15.3% payroll tax) and distributions (no employment tax). Additional compliance requirements but significant tax savings for profitable businesses.

C-Corporations pay 21% federal corporate tax, then shareholders pay tax on dividends (15-23.8% depending on income). Double taxation makes this structure expensive for most small businesses. Benefits include easier access to venture capital, unlimited shareholders, and potential employee benefit advantages.

Using Our S-Corp Calculator

Our Texas S-Corp calculator at slatonfs.com/scorp-tax-calculator provides instant analysis of your potential savings. Enter your gross business revenue, total deductible business expenses, proposed reasonable W-2 salary (typically 40-60% of net income), filing status, and state tax rate (0% for Texas).

The calculator shows side-by-side comparison of your tax liability as sole proprietor versus S-Corp, annual tax savings amount, effective tax rate reduction, and break-even analysis including S-Corp costs.

For a Texas consulting business with $200,000 revenue, $50,000 expenses, and $150,000 net income, using a $75,000 reasonable salary produces these results:

Sole proprietor employment tax: $22,950 (15.3% of $150,000). S-Corp payroll tax: $11,475 (15.3% of $75,000 salary only). Annual savings: $11,475. After $3,000 in S-Corp costs, net savings: $8,475 annually.

Over five years, that’s $42,375 in employment tax savings. Over ten years, $84,750. These savings fund business growth, retirement accounts, or personal financial goals.

Common S-Corp Mistakes to Avoid

Texas businesses frequently make these S-Corp errors: paying unreasonably low salaries (triggers audits and reclassification), mixing personal and business funds (voids liability protection), missing quarterly payroll deposits (generates penalties), failing to file Form 1120-S on time (late filing penalties), not documenting salary decisions (creates audit vulnerability), and taking loans from the S-Corp without proper documentation (creates tax problems).

Proper S-Corp operation requires separating roles: you’re both employee (receiving W-2 wages) and shareholder (receiving distributions). Maintain clear documentation for all transactions. Use separate bank accounts. Follow payroll procedures precisely. File all required forms on time.

Get Professional S-Corp Guidance

S-Corporation election represents a significant tax decision with long-term implications. Making the wrong choice or failing to comply properly can cost thousands in lost savings or penalties.

Slaton Financial Services provides comprehensive S-Corp services for Texas businesses including entity structure analysis, reasonable salary determination and documentation, Form 2553 preparation and filing, payroll system setup and ongoing processing, quarterly estimated tax calculations, annual 1120-S preparation and K-1 distribution, ongoing tax planning and optimization, and IRS audit support if questions arise.

Since 1983, we’ve helped hundreds of Dallas-area businesses optimize their tax structures and maximize savings. Our Texas-based team understands local business conditions, industry compensation standards, and IRS requirements.

Don’t navigate S-Corp status alone or leave money on the table. Use our calculator to estimate your savings, then schedule a consultation to discuss your specific situation.

The Bottom Line

For Texas businesses generating $80,000+ in net income, S-Corporation election typically saves $9,000-$15,000+ annually in employment taxes. These savings compound over years, funding business growth, retirement planning, and financial security.

The decision requires weighing tax savings against additional compliance costs and administrative requirements. For most profitable Texas service businesses, the math favors S-Corp election. The key is proper implementation: reasonable salaries, timely filings, separate accounts, and professional guidance.

Calculate your potential savings now at slatonfs.com/scorp-tax-calculator. See exact numbers based on your business income, proposed salary, and filing status. Then contact our team to discuss implementation.

Texas business owners deserve every legal tax advantage available. S-Corporation election is one of the most powerful—and most underutilized—strategies for reducing employment taxes while maintaining liability protection.

Since 1983, Slaton Financial Services has provided comprehensive tax planning and business structure guidance to Texas businesses. Our S-Corp calculator shows your exact potential savings in under 2 minutes. Calculate your S-Corp tax savings and schedule a free consultation to discuss implementation.